February 13, 2026

If you’re considering your very first loan, it’s normal to feel uncertain. Many Nigerians hesitate to apply for loans due to fear of scams, confusing processes, or being buried in high-interest repayments.

But what if there was a simple, fast, and secure way to borrow money—no paperwork, no collateral, no stress?

In this guide, we’ll walk you through how first-time borrowers in Nigeria can safely access fast loans and why Migo is one of the most trusted micro lending platforms in the country.

Most first-time borrowers are worried about one (or more) of the following:

Will I be scammed?

Will I be charged outrageous interest?

Will I qualify without paperwork or a guarantor?

What happens if I can’t repay on time?

These concerns are valid. Many online loan platforms in Nigeria are unregulated, with hidden fees and aggressive repayment tactics. That’s why choosing a transparent, licensed platform like Migo is crucial for first-time borrowers.

Unlike traditional banks, Migo doesn't require documents, collateral, or even a credit history report. All you need is:

Migo uses smart data and machine learning algorithms to assess your loan eligibility without requiring you to upload payslips or ID cards.

Migo has helped millions of Nigerians access low-interest, short-term loans, many of them for the very first time.

Here’s why Migo stands out for first-timer borrowers:

No documents or guarantors required

Instant loan decision and disbursement

Low entry amounts so you can borrow small and build trust

Clear repayment terms with no hidden fees

Accessible via mobile, USSD, or web platforms

Whether you’re a salary earner, student, or small business owner, Migo offers fast loans tailored to your financial behavior, not just your employment status.

Migo encourages responsible lending. That means:

This "borrow small, grow big" strategy protects you from debt traps and helps you build confidence in managing credit.

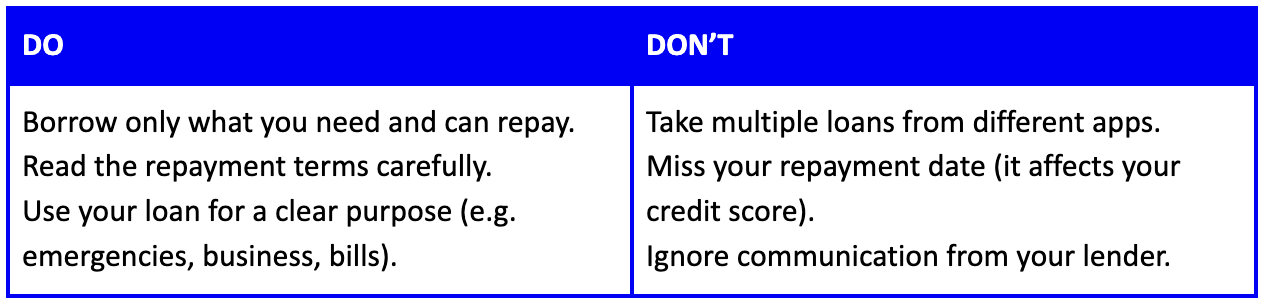

Dos and Don’ts for New Loan Users in Nigeria

With Migo, you’ll get reminders, flexible terms, and the ability to repay in bits via debit card, USSD, or bank transfer.

Taking a loan for the first time doesn’t have to be risky or overwhelming. With Migo, you’re getting a safe, transparent, and digital-first lending experience designed to help you grow, not trap you.

Apply for a fast, secure first-time loan with Migo today. No paperwork, no collateral - just quick, low-interest credit when you need it most.

Need a salary advance loan in Nigeria? Migo offers fast, low-interest payday loans with no paperwork, no collateral, and no stress. Apply online today.

If you threw a rock in a room full of African startup founders today, you would likely hit one offering to give users loans “in just 10 minutes!”

Need fast cash? Migo offers instant loans in Nigeria with no collateral or hidden fees. Get personal loans online in minutes. Safe, secure & stress-free.