October 8, 2025

When the month runs longer than your salary, a payday loan can seem like a lifesaver. Whether it’s for an urgent medical bill, school fees, rent, or just to hold you over till payday, quick credit is sometimes the only option.

But not all payday loans in Nigeria are created equal. With shady apps charging outrageous fees and publicly shaming borrowers, it’s important to borrow smart and safe.

In this post, we’ll show you:

What payday loans are and how they work

How to spot reliable vs. risky loan platforms

Tips to borrow responsibly and avoid debt traps

How Migo offers flexible, transparent payday loans with no stress

Better alternatives to risky loan apps — powered by Migo’s trusted API

Let’s dive in.

A payday loan is a short-term loan meant to help you cover urgent expenses before your next salary hits. In Nigeria, this type of loan is popular among:

With a payday loan, you typically repay within 7–30 days, usually as soon as your salary arrives. It’s meant to bridge gaps, not fund long-term spending.

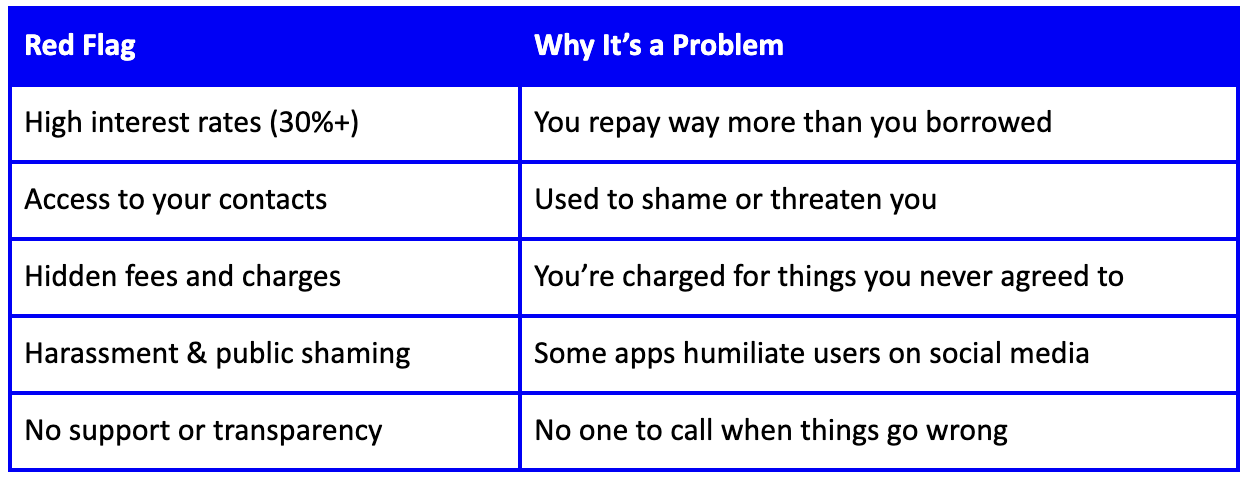

Sadly, some payday loan apps in Nigeria take advantage of people’s desperation. Here are red flags to avoid:

Remember. If it feels shady, it probably is.

You don’t have to fear payday loans. Just use them wisely. Here are five tips to borrow smart:

1. Only borrow what you can repay within your next salary cycle

2. Understand the full cost before accepting any loan offer

3. Avoid stacking loans from multiple platforms at once

4. Track your repayments with reminders or auto-debit

5. Use a lender you trust, like Migo, that offers flexible repayment plans

At Migo, we believe Nigerians deserve access to fair, fast, and flexible loans, not financial traps. That’s why Migo:

Offers payday loans with low interest and no hidden fees.

Doesn’t ask for collateral, paperwork, or a guarantor.

Doesn’t access your phone contacts.

Doesn’t shame or harass borrowers.

Uses smart data to offer personalized credit limits.

Lets you repay in weekly or monthly installments.

Whether you earn a monthly salary or get paid per job, Migo meets you where you are, via USSD, SMS, app, POS, WhatsApp, or our partner banks and fintech platforms.

A payday loan doesn’t have to be a trap. When used wisely, it’s a smart tool for financial flexibility. But make sure you choose a lender that’s transparent, ethical, and easy to work with.

Don’t let unexpected expenses stress you out. Apply for a low-interest, no-collateral payday loan with Migo today. Get cash in minutes. No stress. No drama. Just trusted credit that works for you.

If you threw a rock in a room full of African startup founders today, you would likely hit one offering to give users loans “in just 10 minutes!”

Helping emerging enterprises and individual borrowers access reliable credit is good business. When your model also helps banks guarantee recurring returns, chances are you’ll get business requests from various zip codes. That’s the two-sentence synopsis of Migo’s expansion from a money lending startup with an office in Lagos and registered in San Mateo, California, to international financial services firm about to take on South America.

Learn how omnichannel lending via USSD, POS, and digital platforms drives credit access for low-income customers in Nigeria. Discover how Migo enables inclusive, secure microlending.