February 13, 2026

Need cash before payday? You’re not alone. Many Nigerians experience short-term cash flow gaps for school fees, medical bills, rent, or emergency expenses and need a quick solution without falling into the hands of predatory lenders. That’s where salary advance loans in Nigeria come in.

This post breaks down everything you need to know about salary loans: what they are, how they work, who qualifies, and how Migo makes accessing them fast, secure, and stress-free.

A salary advance loan (or payday loan) is a short-term loan given to employed individuals to help cover expenses before their next paycheck. It’s designed to bridge the gap between financial emergencies and your next salary credit.

Unlike traditional loans, salary advances:

Don’t require collateral

Are approved and disbursed quickly

Are often repaid automatically on your next payday

They’re especially helpful for full-time employees, contractors, and salaried professionals who want a flexible, low-stress borrowing option.

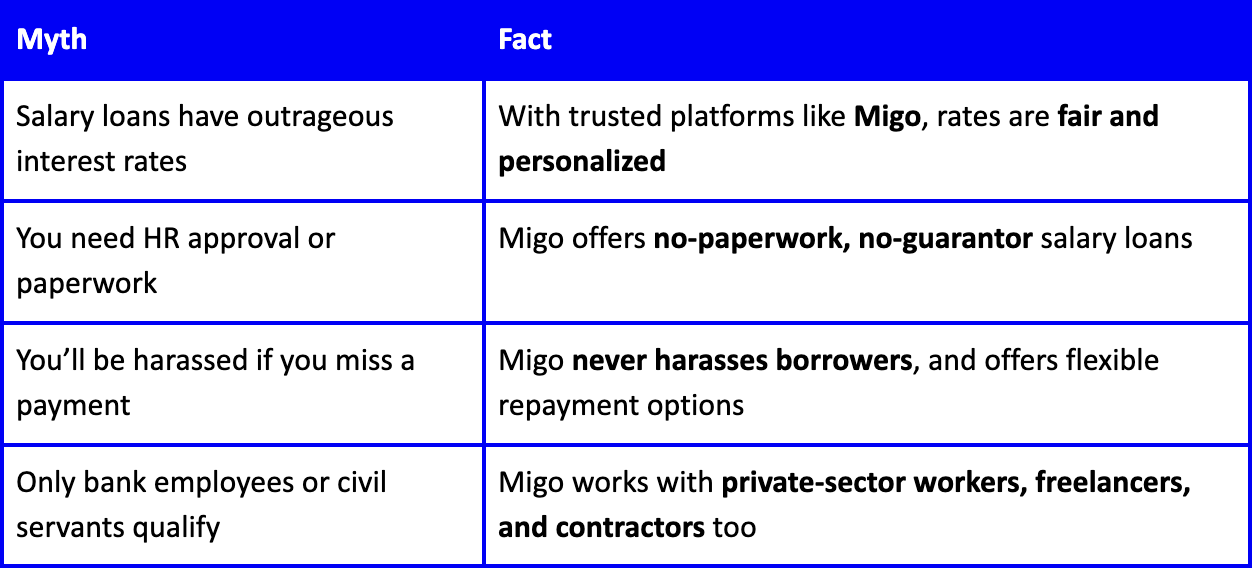

Let’s bust some myths that keep many Nigerians from exploring legitimate salary loan options:

You may qualify for a salary advance loan if you:

Migo’s technology uses your transaction history and behavioral data (not documents) to determine your eligibility. No payslips. No references. No bank visits.

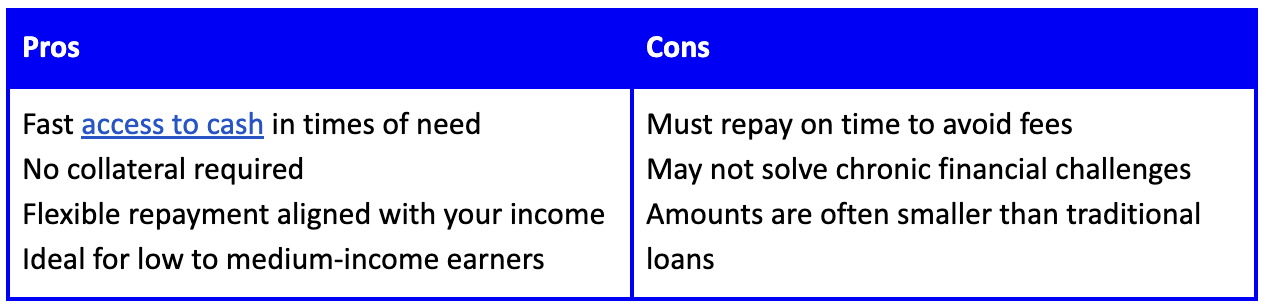

Pros and Cons of Salary-Based Lending

Like all financial tools, salary advances come with benefits and a few things to watch out for.

Migo is not your typical loan app. It’s a cloud-based lending platform that enables Banks, Telcos, FinTechs, and Merchants to offer quick credit to their users including salary earners.

Here’s how Migo makes it easy:

Migo supports weekly or monthly repayment cycles, and your limit can grow over time as you repay responsibly.

If you’re considering a salary advance loan in Nigeria, make sure it comes from a trusted, transparent provider, not a shady loan app that harasses you or your contacts.

With Migo, you get access to:

Low-interest credit

No collateral

Fast disbursement

Clear repayment terms

Seamless digital access

Whether you’re paying rent, handling school fees, or managing unexpected bills, Migo helps you stay in control, without the stress or embarrassment.

With Migo, you can get the cash you need. No collateral, no paperwork, and no hidden charges. Join thousands of Nigerians who rely on Migo to access safe, fast, and affordable credit. Click here to apply now.

Need a personal loan in Nigeria? Learn how to apply, what to expect, and why Migo offers the best no-collateral loan with instant approval and no hidden fees.

Learn how to evaluate loan sites in Nigeria before you apply. Discover red flags, criteria for trusted lenders, and why Migo is a transparent, safe choice for instant loans.